Whelp, we have reached the busiest time of year in real estate in Metro Denver. The time of year where the masses come out to buy and sell a home and what real estate agents live for. From closings, to negotiating, listing homes, presenting multiple offers and showing homes, this time of year is typically a whirlwind. As I catch my breath and continue to work hard for clients, I have rounded up a few interesting articles I have found thought provoking and interesting.

As the oldest segment of millennials reach 40, businesses are tapping into the segment called ‘millennial parenthood’. Sarah Robinson and Noria Morales, co-founders of family space The Wonder created a space for families in Tribecca. The Wonder isn’t designed to cater only to kids; it also includes adult-friendly areas, What other businesses will we see start to cater to the “older” millennial?

Wondering what the best cities are for new college grads? Go here. Hint: Denver is number 9! If you are considering buying a home, take a look at the 25 best neighborhoods in metro Denver.

This year I have vowed to sharpen my public speaking skills and even went as far as hiring a professional speaking coach. Why would I do this? Because public speaking is critical to your success.

Starting to feel a bit distracted by your tech? According to the author of Digital Minimalism, this is exactly what they want to happen. Consider a digital declutter. Start by accessing your smartphone and app use and take 30 days off. After reading this book, I deleted Facebook and Instagram, allowing use only on my laptop and for no longer than an hour a day. I am curious to see how much more productive I am without being attached to social media.

Of course, we also want to have fun. If you are staying in Denver for Memorial Day weekend, take a look at these ten things to do in Denver this Memorial Day.

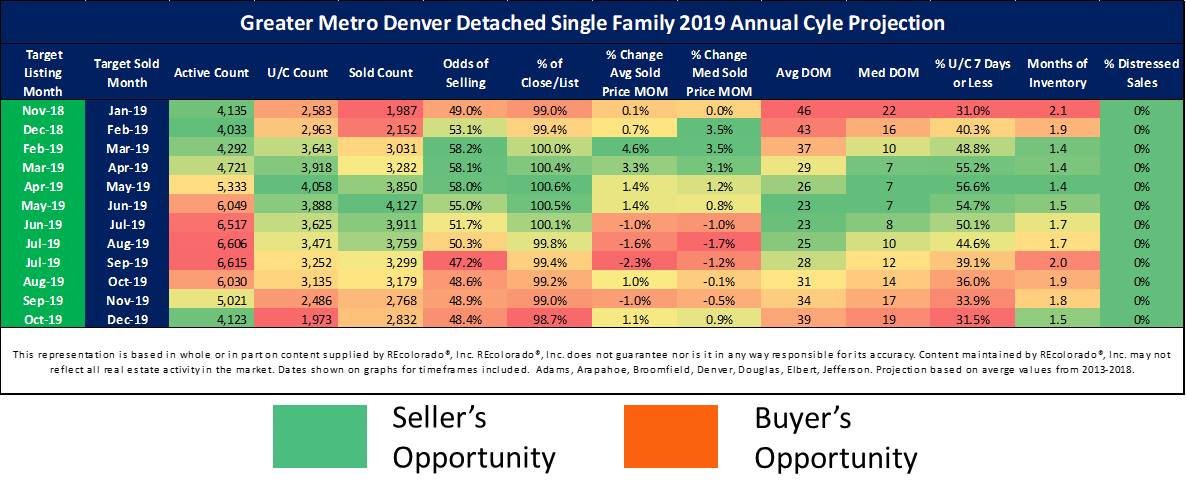

Speaking of Memorial Day, keep in mind Memorial Day is typically when we start seeing the real estate market slowly start to favor the homebuyer. This presents a great opportunity for buyers entering the market or buyers that have had a hard time competing for a home.

Liz is broker and owner of Liz Daigle Realty.

stove-toplighting, bedside lamps, ceiling fan lights, and other secondary light sources.

stove-toplighting, bedside lamps, ceiling fan lights, and other secondary light sources.