Happy New Year! If you read the last blog post of 2018 and have decided that 2019 will be the year to buy a home, then you will want to keep reading. It is no secret that the Denver real estate market has been a whirlwind for the last several years with a very strong seller’s market. We have seen the average home price continue to rise year over year and experienced double-digit appreciation. Although, when we ended 2018 there were a number of price reductions, less multiple offer situations and homes staying on the market longer. What should we expect for 2019 in the Denver real estate market?

It may have felt like a cool off at the end of 2018 but even just ten days into 2019 we are starting to see it go back to “normal”. “Normal” meaning the completely abnormal market we have been in with homes going under contract within a few days and often the seller receiving multiple offers. In January, more buyers come on the market while significantly less sellers enter the market. Again, creating the same song-and-dance that we have seen for years with very low inventory and plenty of buyers.

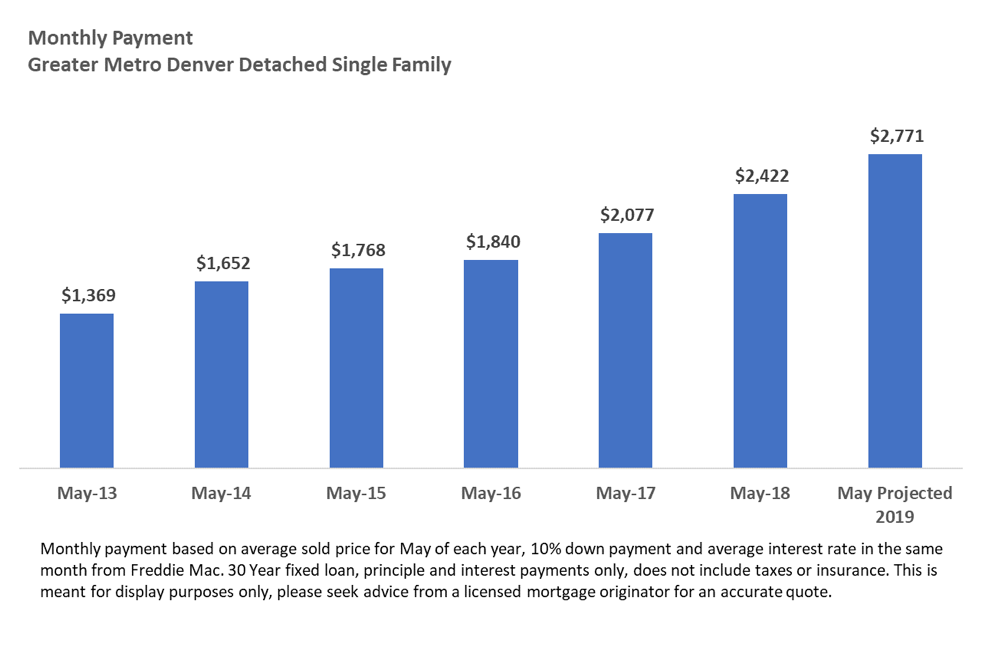

As anticipated, the market slowdown that we saw at the end of 2018 was seasonal and we are back into our competitive real estate market. Over the last six years, we have seen 8-11% appreciation each year and we are expecting to continue seeing the same level of appreciation with an average purchase price of a detached home of $575,000. (This is up 70% from the average purchase price of $355,000 in May 2013.). Although, we may be seeing a new trend, “a slightly less of a seller’s market“. This means there are fewer multiple offers on a home and a bit less competition.

Of course, it is not only the increase in purchase price that will affect your monthly payment. An additional concern is interest rates. Rates have slowly ticked up in 2018 and the Federal Reserve has announced that they do intend to increase interest rates. (Although, the mortgage rates are not directly tied to this, it does mean that mortgage rates may follow suit. The best number to keep an eye on is the ten-year treasury note. Typically, once the ten-year treasury note increases, mortgage rates follow.) In 2019, interest rates could come close to 5% or 5.5%.

Given the rise in interest rates and prices since 2013, this graph shows you what the monthly payment for a detached home has increased to and what it is projected to be come May 2019.

Here is the same information for attached homes.

Liz is broker and owner of Liz Daigle Realty.